What is Freight Insurance?

Francisca Olive / July 2023

What matters most to you as a shipper is that your shipment arrives at its destination in one piece and on schedule. Nevertheless, mishaps can occur, compromising your shipment’s safety. Also, they are notoriously hard to predict. But this does not mean that you must accept the loss. Read on to learn more about freight insurance (or cargo insurance) and how it can help you recover freight loss in case of an incident.

What is Cargo Insurance?

A cargo insurance policy offers complete or partial protection against losses that may occur to the cargo in transit. Cargo insurance gives you peace of mind while your shipment is in transit. If your shipment is damaged, the insurance company will pay the replacement cost. Cargo insurance can be purchased from either the shipping business or from independent insurance agencies.

Do I Need Freight Insurance?

Getting cargo insurance is not compulsory, but it is recommended. You, the shipper, are under no obligation to obtain cargo insurance. You are within the law to ship without purchasing cargo insurance. However, the carrier will offer you some protection in the form of freight liability, which is not insurance.

And thus, the question arises: why sign up and pay a premium for extra protection? The truth is that you are the most qualified individual to guarantee the safety of your goods. The transportation company or carrier may provide some form of insurance, but they’d rather not be responsible for any damages.

The value of the shipment belongs to you, the shipper. The best way to recover from a loss is to purchase cargo insurance.

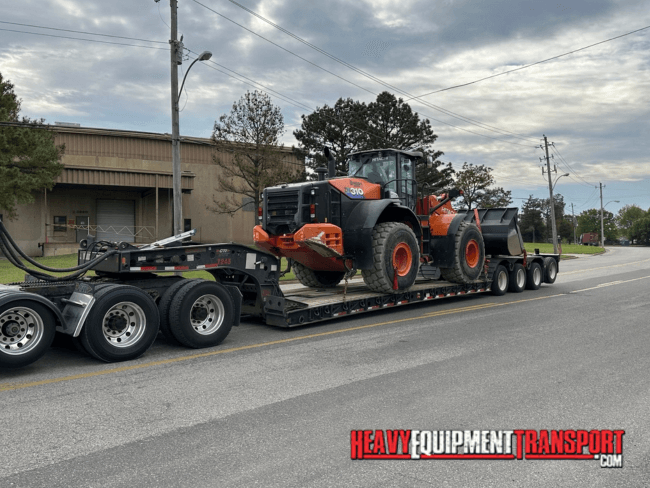

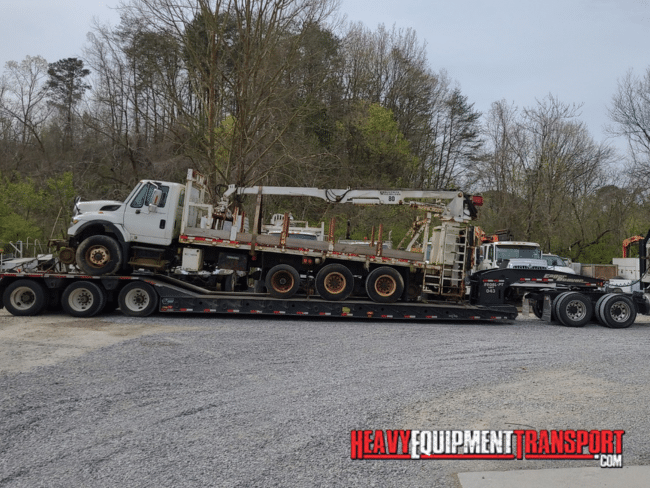

Transport Your Freight Today

Heavy Equipment Transport is always available for a quote. Fill out the form or give us a call now! (888) 730-2951

Freight Liability vs. Cargo Insurance

Every shipment comes with limited liability coverage, and the word “limited” is the fundamental difference between the two types of coverage. The amount of protection depends on the specifics of the goods being transported and the terms set by the carrier. Most of the time, it won’t be enough to cover the value of the goods, especially for high-value goods.

If the damage to your shipment was the carrier’s fault, they must reimburse you. If you want the full amount of the carrier’s liability coverage, you’ll need to show that your items were properly packed and in good condition when they were picked up. Bad weather or natural calamities may reduce the carrier’s responsibility for your shipment’s safety.

When you get cargo insurance, you are protected no matter what happens with your cargo. Furthermore, you won’t have to provide evidence that the incident was the carrier’s fault. Having cargo insurance means you won’t have to wait around for your claim to be processed or worry about whether or not you’ll receive your money back if something goes wrong with your shipment.

Compared to freight liability, cargo insurance provides the shipper with much more peace of mind and allows for a quicker payout. It takes an average of 30 days to process a claim, unlike freight liability which can take several months. Investing in cargo insurance protects your business from financial loss. Furthermore, insurance agents will handle all necessary documentation on your behalf.

What is Covered Under Freight Insurance?

Cargo insurance policies vary widely, but some of the incidents that are typically covered include acts of war and piracy, as well as natural catastrophes, vehicle accidents, cargo abandonment, and customs refusal. Problems that stem from factors over which the shipper has control, such as damaged goods brought on by inadequate packaging, defective goods, or dangerous materials, might not be compensated.

Things to Consider

Before signing a cargo insurance policy, read the fine print. Don’t settle for anything less than a comprehensive policy. Here are some steps to ensure smooth claim filing and cargo insurance coverage:

● Your claim could be denied if your insurance policy does not specify the freight class and type. Check to see that the policy fully addresses all of your needs.

● Purchase the policy beforehand, and ensure that the carrier is included.

● Ensure that delicate materials like glass, marble, and granite are professionally packed. The insurance company won’t pay out a claim without seeing proof, such as packing slips and photos.

● Ensure you indicate the true worth of your shipment. The claim settlement may be decreased should there be a disparity between the declared and actual value.

● It is best to photograph your container and cargo before transport. The images will aid the insurer in determining the degree of the damage

● You’ll also need to verify that the goods are insurable.

Key Takeaway

When it comes to protecting your cargo, you can’t afford not to purchase cargo insurance. If you haven’t already done so, contact your shipping company now and ask about the various insurance policies they provide.

William Thomas

Heavy Transport Specialist

Being able to lead a team of such talented logistics agents has been a wonderful experience over the past ten years. If you would like to know anything more about the heavy equipment transport services we offer, don't hesitate to give us a call!