Do I Need Insurance to Move a Shipping Container?

Francisca Olive / June 2023

Shipping goods in containers comes with its own risks. Most of us don’t give much thought to whether or not we should insure our companies, houses, or vehicles. Thus, you shouldn’t hesitate to have your container shipments insured, as they are far more likely to be damaged. Read on to learn more about why you need shipping container transport insurance.

Container Moving Insurance

You can get compensation through a container shipping insurance policy if your cargo is lost or damaged during transit (provided it was transported in a container). This type of insurance is typically purchased by cargo owners, freight forwarders, and other parties involved in the shipping process to protect their goods from risks that can occur during transportation. Weather conditions, ship collisions, and other hazards can all contribute to these losses. Let’s dig into why container shipping insurance is vital and how it may help you avoid financial ruin in the event of a damaged container.

Why You Should Get Shipping Container Transport Insurance

While container shipping insurance may not be a legal requirement, it is important to get it for several reasons.

➤ Protection Against Loss or Damage

During transit, shipping containers are vulnerable to several dangers, including human error, vehicle mishaps, fires, and weather-related calamities like hurricanes and typhoons. Container insurance can protect against damage or loss of a shipping container in case of these events.

➤ Compliance

Some nations require certain types of insurance for overseas shipments. For instance, the International Maritime Organization (IMO) mandates that all ships carry insurance to cover any environmental harm incurred due to an accident or any other occurrence. If you don’t follow the rules, you might face fines or possibly have your shipment seized.

➤ Customization

Container insurance can be tailored to your needs and requirements, providing the right coverage for your cargo and the shipping route. This allows you to select the level of protection right for you, whether it’s the bare minimum to cover losses and damages or a more extensive plan that protects you from liability and other risks.

➤ Peace of Mind

Accidents and mishaps can occur despite the best-laid plans. Knowing that your goods are covered in the event of an accident during container transit is priceless.

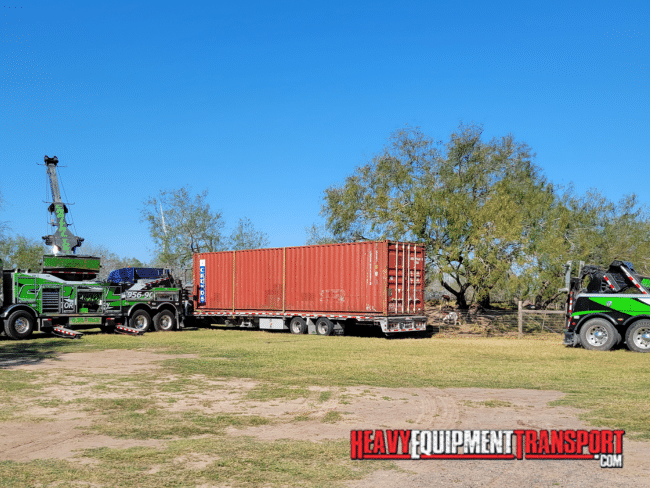

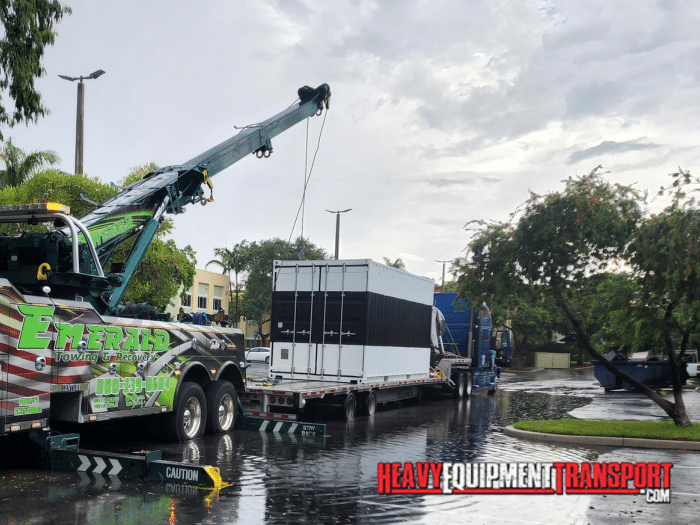

Transport Your Container Today

Heavy Equipment Transport is always available for a quote. Fill out the form or give us a call now! (888) 730-2951

Types of Container Transport Insurance

➤ All-Risk Insurance

In terms of shipping container protection, this is your best bet. All-risk insurance protects against any risk, with the exceptions specifically outlined in the policy. Companies shipping valuable or delicate cargo should seriously consider getting all-risk insurance.

➤ Total Loss Insurance

A total loss insurance policy covers the complete loss of a container. This can result from theft during transport or a container loss at sea. Although this type of insurance provides less coverage than all-risk insurance, it is less expensive.

➤ General Average Insurance

General average insurance aims to compensate policyholders for their proportionate part of the financial losses and expenses incurred due to a shipping accident. When goods are transported by a common carrier (like a container ship), all parties often purchase this insurance to cover the shared risk of loss.

➤ War Risk Insurance

War risk insurance provides coverage for losses or damage to cargo caused by acts of war or political instability, such as civil unrest, terrorism, or war. This type of insurance is recommended for businesses shipping cargo in containers through high-risk areas.

➤ Marine Insurance

Marine insurance protects containers being transported via sea. When the containers are returned to their owner, they undergo a thorough inspection. If the owner discovers that the container has been damaged, they will calculate how much it will cost to repair it. The container user is then given this estimate. The user then sets up a second inspection so they can double-check the estimate. A cost estimate is then negotiated between the user and the owner. After that, the insurance brokers are brought in to settle the charges. When insurance is not included, users will be required to pay for the container, and shippers will cover the damage to the cargo.

The carrier must ensure the shipment arrives in perfect condition and without damage. The shipper (you!) is responsible for ensuring the goods are in good condition and ready to be picked up by the carrier. Damage must be documented both in terms of quantity and degree. Any destruction caused by extreme weather, acts of war or terrorism, or where it can be proven that the company shipping the goods was irresponsible in packaging or labeling the cargo are all examples of situations in which the carrier is not liable for damage claims.

Key Takeaway

Opt for shipping container transport insurance and lower the liability risk when moving a shipping container.

William Thomas

Heavy Transport Specialist

Being able to lead a team of such talented logistics agents has been a wonderful experience over the past ten years. If you would like to know anything more about the heavy equipment transport services we offer, don't hesitate to give us a call!